Inditex (the owner of Zara, Pull&Bear, Massimo Dutti, Oysho, Bershka and Stradivarius) reported a 2023 net profit of 5.4 billion euros ($5.7B), up by 30% from 2022. Gross sales also went up 10% to 36 billion euros ($39 billion). Although the company didn’t break out individual figures, it’s safe to assume Zara is fueling the engine, the same way Louis Vuitton drives LVMH’s bottom line. Although they operate at different ends of the fashion spectrum, Inditex and LVMH have a lot in common. Through a series of smart acquisitions, a strong focus on operational excellence and relentless image marketing, their founders have managed to helm two of the world’s most successful (and profitable) fashion companies.

Indeed, Zara is the biggest fast-fashion brand in the world (for context: Shein’s 2023 net profit was $2 billion, H&M’s $828M and Mango drove $3.1B in sales last year).

How did Zara get here?

A Brief History

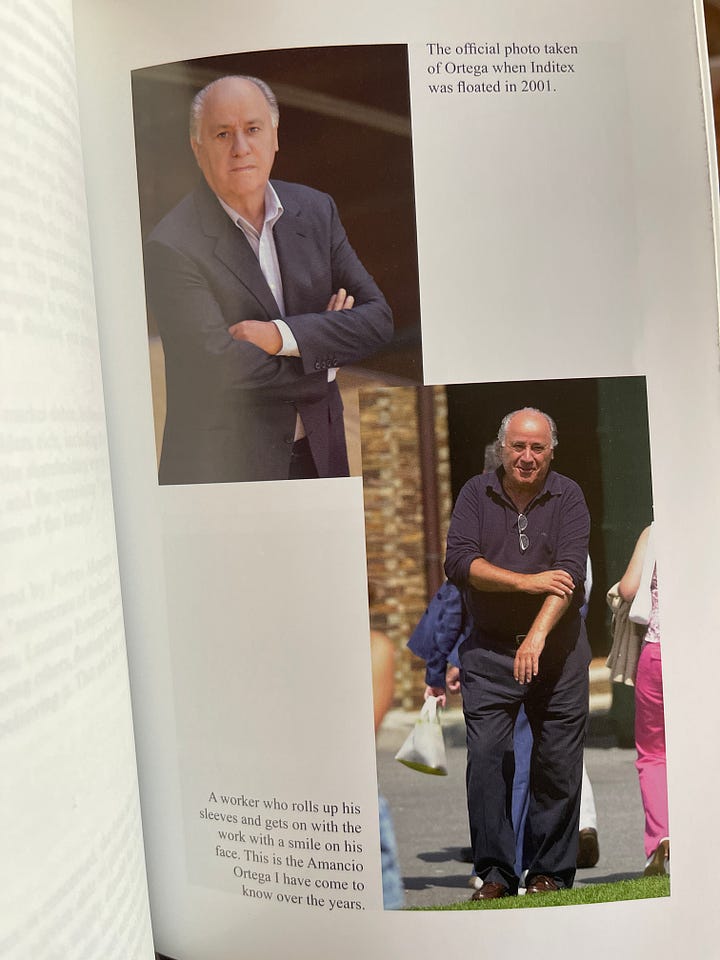

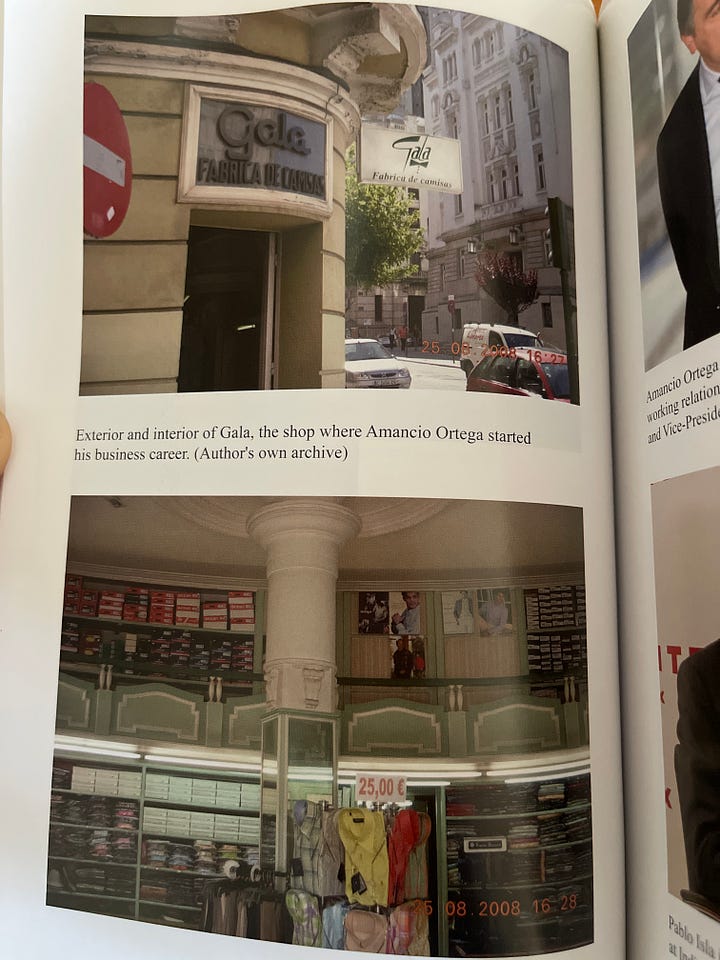

Zara’s story begins in La Coruña, Spain with Amancio Ortega Gaona. The son of a low-earning railway worker and housewife, Ortega started working at 13, first as an errand boy for a local shirtmaker and eventually as the manager of a shop called Gala. He falls in love with the garment trade and quits to become a full-time manufacturer, eventually opening the first Zara boutique in 1975.

How Zara Became Successful

The Business Case Study

Two things: quick response manufacturing and vertical integration. Quick Response, a system that allows brands to produce and manage their inventory in real time, was developed in the mid ‘80s by the US Apparel Manufacturing Association in response to—ironically—offshoring. As free trade agreements facilitated production overseas, US unions developed a tool to compete with low-cost imports from abroad, and it allowed them to shorten the production timeline and place orders according to market demand (thus reducing overproduction and waste). As QR gained traction, foreign competitors took notice. Enter Ortega, who applied the concept to his numerous brands. QR is the reason why Zara already offers runway knockoffs (mesh flats, bowling bags) before the originals hit retail.